Definition Of Money Laundering Poca

The concept of money laundering is essential to be understood for these working in the financial sector. It's a process by which dirty cash is transformed into clean money. The sources of the money in precise are criminal and the money is invested in a way that makes it seem like clean money and hide the id of the felony part of the cash earned.

Whereas executing the financial transactions and establishing relationship with the brand new customers or sustaining current customers the duty of adopting sufficient measures lie on every one who is part of the organization. The identification of such factor to start with is simple to deal with instead realizing and encountering such situations afterward in the transaction stage. The central financial institution in any country supplies complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to deter such situations.

Eoin OShea discusses how recent case law will affect the duties of accountants under the money laundering regulations. Lawyers engaged in litigation are no longer required to inform on clients whom they suspect of being engaged in crime or money laundering.

Pdf Anti Money Laundering Regulation And The Art Market

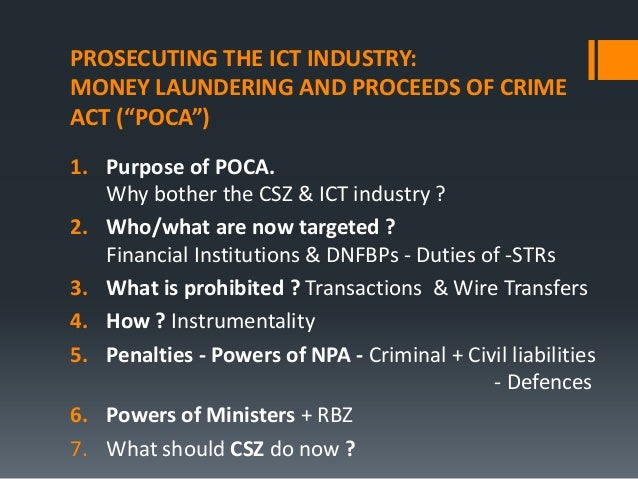

To provide for the recovery of the proceeds of unlawful activity.

Definition of money laundering poca. The Proceeds of Crime Act 2002. To criminalise certain activities associated with gangs. The other two are to be found in sections 328 and 329.

POCA 2002 provides for three types of disclosure. However given the broad definition of laundering under POCA such transactions would still constitute the offence of money-laundering. This includes the inchoate offences of attempting helping or encouraging.

Money laundering - Out of POCA. To prohibit certain activities relating to racketeering activities. None of the definitions use the words money or laundering.

Money laundering offences under the Proceeds of Crime Act 2002 POCA. A person commits an offence if he conceals disguises converts or transfers criminal property or removes criminal property from England and Wales Scotland or Northern Ireland. To put it simply the POCA discusses and defines offences in money laundering as the following.

To provide for the prohibition of money laundering and for an obligation to report certain information. A person does not commit one of those offences if they have received appropriate consent aka a DAML from the NCA. The Proceeds of Crime Act 2002 POCA caused concern to those in the regulated sector - including financial professionals accountants and lawyers - because it created a series of offences two of which were of importance to honest professionals.

Onerous reporting obligations under the money laundering. Definition money laundering POCA. The prosecution argued that property amounts to criminal property if it constitutes or represents a benefit of criminal conduct and therefore if there was an underlying chose in action as in the definition of property under section 3409 of POCA that money paid into the account represented the money paid would satisfy the definition of criminal property.

The PoCA will consolidate update and expand the money laundering offences in the Criminal Justice Act 1988 the Drug Trafficking Act 1994 and in the Terrorism Act 2000. The statutory definition of money laundering is an act which constitutes an offence under sections 327 328 or 329 of POCA. To provide for the prohibition of money laundering and for an obligation to report certain information.

A protected disclosure an authorised disclosure and. Because of the definition of criminal property at section 340 all three. The NCA is empowered to provide these criminal defences in law under s335 of POCA.

If a person conceals disguises converts transfers or removes from the jurisdiction property which is or represents the proceeds of crime which the person knows or. Section 327 creates one of three principal money laundering offences. To prohibit certain activities relating to racketeering activities.

These offences are punishable by a maximum of 14 years imprisonment andor a fine. The Proceeds of Crime Act 2002 PoCA comes into force on 24th February 2003 and deals with matters such as. Section 4 contrary to section 6 distinguishes itself in that it requires some further activity in connection with the predicate offence aimed to convert the status of property from illegitimate to legitimate.

Definition of Money Laundering Acts In short POCA describes the money laundering offences as follows. Athough the criminal offence is new the activity. Money laundering is the illegal process of making large amounts of money generated by a criminal activity such as drug trafficking or terrorist funding appear to have come from a legitimate.

The Proceeds of Crime Act POCA published in 2002 changed the way we understand money laundering offences. The Proceeds of Crime Act 2002 c29 POCA is an Act of the Parliament of the United Kingdom which provides for the confiscation or civil recovery of the proceeds from crime and contains the principal money laundering legislation in the UK. Money laundering or conspiracyattempt to money launder is an offence under sections 327-329 of the POCA.

During this initial phase the money launderer introduces his illegal proceeds into the financial system. POCA introduces measures to combat organised crime money laundering and criminal gang activities. Money launderers are the most vulnerable at this stage as placing large amounts of cash into the legitimate financial system may raise suspicions of officials and he may get caught.

To introduce measures to combat organised crime money laundering and criminal gang activities. The effects of POCA is to criminalise three principal money laundering offences. The money laundering regime under POCA 2002 requires individuals to make a disclosure in respect of transactions they are undertaking on another persons behalf in order to obtain a defence to one of the principle money laundering offences.

Money Laundering And Asset Tracing Explanation And Offences Name Tanya Kamaly Studocu

Money Laundering Elements Of Offence Part 1 Definitions And Obliged Entities

5 Basic Money Laundering Offences Deltanet

Financial Intelligence Centre Act Defining Money Laundering United Nations Definition Any Act Or Attempted Act To Disguise The Source Of Money Or Ppt Download

Money Laundering Elements Of Offence Part 1 Definitions And Obliged Entities

Pocla Antimoney Laundering And Confiscation Projects Law Commission

Money Laundering Elements Of Offence Part 1 Definitions And Obliged Entities

Pdf Money Laundering Trends In South Africa

Introduction In Anti Money Laundering And Counter Terrorism Financing Law And Policy

Pdf Prevention Of Money Laundering And The Role Of Asset Recovery

Anti Money Laundering 2021 Isle Of Man Iclg

Anti Money Laundering Policy Introduction Pdf Free Download

Doc A Critical Analysis Of Money Laundering Act Autosaved Chiedozie Ndubuisi Academia Edu

The world of regulations can appear to be a bowl of alphabet soup at occasions. US money laundering rules aren't any exception. We've compiled a listing of the top ten money laundering acronyms and their definitions. TMP Threat is consulting firm focused on protecting financial services by reducing danger, fraud and losses. We've big bank experience in operational and regulatory danger. We have now a robust background in program administration, regulatory and operational risk in addition to Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many adverse penalties to the organization as a result of risks it presents. It will increase the probability of main dangers and the opportunity price of the financial institution and in the end causes the financial institution to face losses.

Comments

Post a Comment